COVID-19 is not only threatening your health. It may also be affecting your income, forcing you to downsize and reduce your spending. While most people are cutting trivial expenses like online subscriptions, and clothing purchases, you may be making more drastic cuts. In fact, research shows when people are struggling financially, they are more likely to cut car insurance premiums by eliminating add-ons like Uninsured and Underinsured Motorist coverage. We understand. But we think cutting car insurance coverage is a big mistake and the experts at KL want you to know why.

Florida Is Unfortunately #1

The Sun Sentinel reported Florida’s unemployment rate jumped to 11.3% in July–an exponential increase from 2.8% in November 2019. To make matters worse, Florida is already the third most expensive state in the country for auto coverage according to the Insurance Information Institute. This is largely due to the amount of uninsured and underinsured drivers on the road. Of all 50 states, Florida has the highest percentage of uninsured motorists at a whopping 26.7%, or 1 in 4 drivers. Unfortunately, it’s very difficult to sue uninsured drivers for personal injury damages, because they don’t generally have the money or assets to pay.

Times are tough and it makes sense why you may be looking for an insurance plan with no-frills and low monthly premiums. But the bare minimum simply isn’t enough–especially in a state with much higher motor vehicle accidents coupled with more uninsured drivers with policies that cannot cover expensive car repairs or medical expenses.

COVID’s Impact on Auto Policies

If you are struggling to pay monthly bills during this COVID recession, it’s certainly tempting to reduce insurance coverage to the bare minimum. But that could have serious consequences, especially if your livelihood depends on driving. If you are an essential worker like a doctor or nurse, food delivery driver, truck driver, contractor, or a professional who must travel site-to-site, you are on the road regularly and at a greater risk of getting into an accident. This is a risk you can only afford if you have the proper Uninsured (UM) and Underinsured (UIM) coverage in your auto policy. Otherwise you may be stuck with expensive medical bills and no way to recover damages through legal action.

Understanding UM and UIM Coverage

UM/UIM coverage is an optional protection that helps compensate you for your losses if you’re hit by a driver who doesn’t have adequate bodily injury liability. While optional, UM/UIM coverage protects you from being buried with exorbitant expenses when you are the victim of a crash with someone who’s underinsured or who has no insurance at all. Without UM/UIM, you may be left with no option to pay for your pain. And the cost of car repairs and medical expenses could be life changing.

Cost of a Car Accident in Florida

In Florida, drivers are only required to carry $10,000 in Property Damage Liability (PDL) and $10,000 in Personal Injury Protection (PIP). PDL helps you pay the damage to another person’s property in an accident that you cause. PIP, on the other hand, helps you pay for your own medical expenses–regardless of who caused the crash.

That’s because Florida is a no-fault state, which means you must look to your own insurance to recover personal injury costs, even if you’re the victim. You can only look outside the at-fault system if you are seriously or permanently injured. PIP insurance is a great starting point but it will not cover extensive medical bills and lost wages, pain and suffering, or any other human damages caused by the accident like inconvenience or loss of enjoyment of life.

Unfortunately, Florida’s minimum requirements are some of the lowest in the country and do not cover the full cost of an average accident with injuries. According to the National Safety Council Injury Facts, the average economic cost by injury severity or crash is approximately $12,200. For a disabling injury, claims shoot up to almost $100,000. That means if you are in a car accident and facing exorbitant medical bills, you’ll need to try to recover personal injury damages from the other driver.

Why It’s a Mistake to Reject UM/UIM Coverage

To cover your remaining losses, you’ll need to file a claim under the other driver’s liability insurance policy. But what if the other driver is uninsured or sufficient bodily injury coverage needed to pay for your injuries?

Technically you could sue the at-fault uninsured driver but it’s nearly impossible to recover money from someone who doesn’t have the funds to pay. You could also rely on your health insurance to help cover the costs. But let’s face it, even with insurance you may be responsible for paying unaffordable deductibles and copays. Moreover, your health insurance does not cover emotional suffering or lost income. The only way to recover the full extent of the damages is by making a claim through your insurer under your UM/UIM coverage.

At KL, we’ve fought for countless car crash victims–some with and others without UM/UIM. Recently we helped a woman who was hit by an underinsured drunk driver. The drunk driver carried the minimum bodily injury coverage of $10,000. However, thankfully she had $100,000 in UIM coverage and we were able to secure a settlement of $110,000. By contrast, the family of a teenage boy who was struck by an inattentive driver contacted our team for help last year. Unfortunately the family did not have UM coverage and we were unable to secure compensation above the other driver’s $10,000 personal injury liability limit.

UM/UIM insurance is so important if you get into a car accident that’s not your fault because it covers the medical bills that exceed your PIP limit. It also covers lost wages, and pain and suffering. When you have UM coverage, personal injury lawyers like KL can fight for you to recover the maximum compensation from your car insurance provider. Without it we are left with very few legal options to get you the money you deserve.

UM/UIM coverage is especially vital if you are one of the South Florida professionals who rely on frequent use of a vehicle such as brokers, commercial drivers, city workers, or delivery drivers.

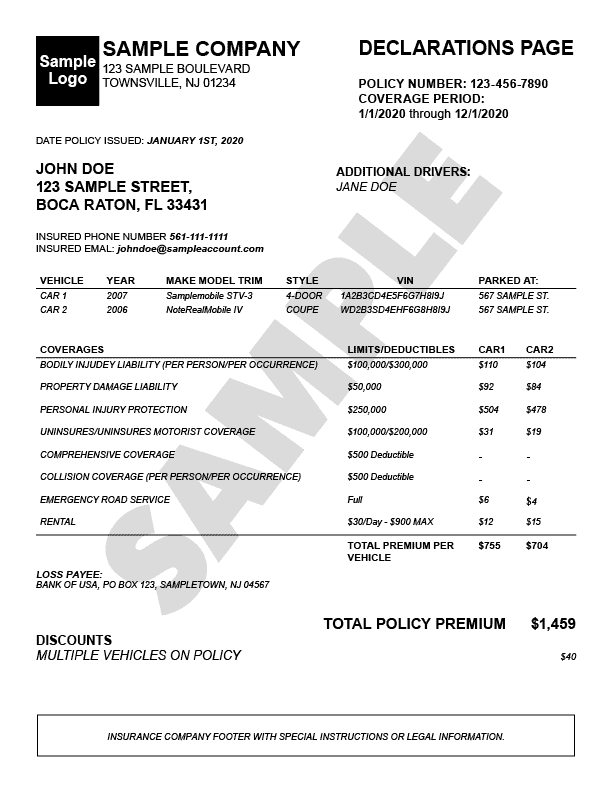

Free Auto Policy Assessment

We know times are tough. South Floridians are looking for ways to reduce their monthly costs and auto insurance companies have been advertising premium reductions as a means of saving. This creates greater risk for people like you who rely on their vehicles to make a living. We want to help you avoid serious financial hardship due to an unexpected car accident. That’s why we are offering a free auto policy assessment. We’ll review your policy and identify any gaps in your coverage. It’s that simple. Follow the instructions below to get started.

Get a Free Evaluation of Your Motorist Coverage

How it works

- Fill out the contact information

- Upload a JPG, PNG or PDF of the “Declarations” page (max 5MB file size)

- Click Submit

- You’ll receive an email confirmation within minutes

- Allow us 2-5 days to review and we’ll contact you with an assessment and recommendations