Summer is here, but travel plans have been widely disrupted due to the pandemic. Summer camps are closing, leaving families scrambling to find ways to occupy their free time. But they don’t want to fly. In fact, people are less willing to fly now than they were at the height of the coronavirus lockdowns. That means families are taking more road trips this year. But many of them won’t have proper protection in the case of an accident with an at-fault driver who doesn’t have enough insurance to cover the damages.

Florida is in the top five states for uninsured motorists–at nearly 1 in 3 drivers. The consequences of getting into a crash with one means you’re left with a bill and no choice but to go to court to recover the damages. On top of those grim statistics, your chances of crashing into an uninsured or underinsured motorist this summer is even higher. That’s why it’s so important to have plans that include uninsured motorist (“UM”) or underinsured motorist (“UIM”) coverage.

Why You’re At Greater Risk This Summer

1. It’s rainy season in Florida

As a Floridian, you don’t need an explanation of what happens every day at 3 p.m. during rainy season. But you need to know that rain causes half of all weather-related crashes. You should also be aware of a study that shows rainy conditions in Florida increase crash rates by 2.6 times.

2. Economic times are tough

As an American living through the COVID-19 crisis, you know first-hand that hard-working citizens are suffering due to circumstances out of their control. Research shows that during tough economic times like this, people are more likely to seek insurance plans with lower monthly premiums to save money. That means they may choose to forgo optional coverage add-ons such as liability protection. Liability makes insurance plans slightly more expensive, but they’re so important because they cover the cost of the other driver’s property and bodily injuries. If an at-fault driver does not have liability protection, and you don’t have UIM coverage, you may need to go to court to recover the damages.

Even worse, economic hardship may cause people to skirt the legal requirements and forgo insurance coverage altogether.

3. People are planning to take more road trips

Due to the COVID pandemic, summer camps are shutting down and air travel is unpredictable. Moreover, people are scared to fly. According to a recent briefing by the International Air Transport Association, only 45% of people said they would consider air travel in the next couple of months.

But many families still want to get away. To avoid quarantine insanity, while reducing their risk of infection, families are hitting the road this year instead. The proof is in the numbers. According to a recent Fox Business article, RV dealers have seen up to a 170% increase in sales for May compared to the same time last year. RVshare also reported a 3-fold increase in bookings.

4. Florida is reopening

Every Florida county except Broward, Miami Dade, and Palm Beach is making plans to enter phase three of reopening. That means professional offices are already back in business, hotels and restaurants are increasing capacity limits, and bars, and movie theaters and casinos are getting ready to serve customers again. Even Disney World recently announced plans to safely reopen in July. Reopenings mean a return to congested roadways and increased risks of accidents.

Car Accident Facts

Approximately 40% of accidents in Florida lead to some kind of injury. As a result, CDC officials estimate that victims who are hospitalized will owe about $57,000 in medical expenses over their lifetimes. Luckily with the right insurance coverage, Floridians never have to risk facing that outcome.

Medical bills are expensive, and if you get into a car accident the last worry you need to have is how you’re going to pay for it. For Floridians especially, the risks are even greater. As a Florida driver, you must be prepared for this fact and take a good look at your insurance policy to find out if you have enough coverage. At KL, we’ve represented crash victims with and without UM/UIM coverage. And we know first hand how much of a difference it makes.

A Client Case With UM/UIM Coverage

We had a young woman who was involved in a crash with a drunk driver. The drunk driver overshot a left turn into oncoming traffic. He lost control during the turn, hit the median, went into the oncoming traffic, and our client struck his vehicle. She had an immediate series of significant and permanent burns on her body from the airbag, a wrist fracture, and spinal injuries. She incurred over $22,000.00 in medical bills. The defendant driver, who blew twice the legal limit, only carried $10,000.00 in bodily injury coverage – the minimum amount sold in Florida. Fortunately, our client had Underinsured Motorist Coverage of $100,000.00 to help compensate her for her injuries. We secured the entire coverages available of $110,000.00 plus had costs paid by the bodily injury carrier. This case illustrates the importance in having UM/UIM coverage but also makes a strong case that carrying more is better as arguably her case had a value in excess of the amount of the recovery.

A Client Case Without UM/UIM Coverage

A few years ago we were contacted by a family whose son was struck and killed in a vehicle on I-95. The young man was a teenager. He was in the process of getting his car off the shoulder and onto I-95 when an inattentive driver struck his vehicle at full speed. The other driver was operating a large size truck and was clearly not paying attention to conditions ahead of him. Unfortunately, the young man died on the way to the hospital. The driver of the truck that caused the crash only carried $10,000.00 in bodily injury limits. The family of the teenager did not carry any UM/UIM benefits. While money could never replace the loss of their child, they never got the satisfaction of accountability for the crash, or any monetary compensation to assist them in their grieving process.

You Sure You’re Properly Covered?

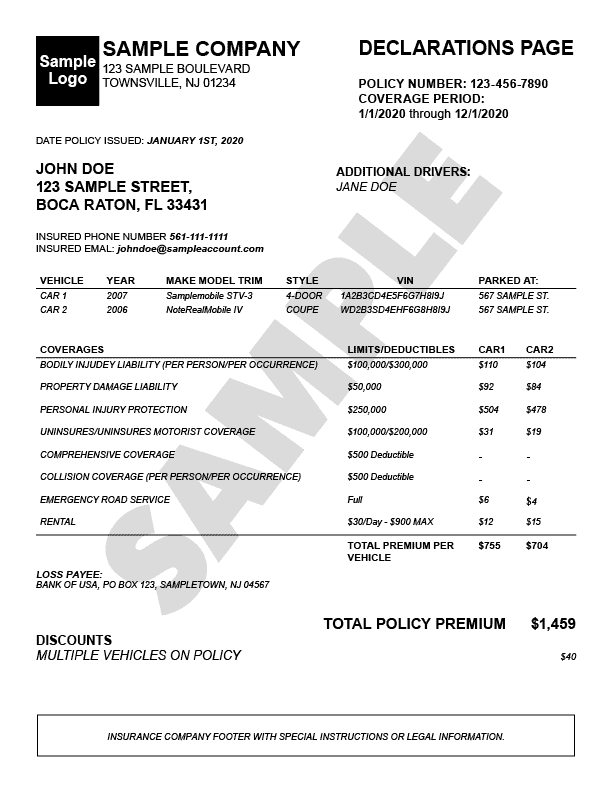

The facts above speak volumes. If you started to commute to work again, or planning for a summer road trip, now is the perfect time to check your insurance policy, just in case. At KL, we go above and beyond to make things easy. Whether you’ve been a client or not, we’re ready to review your policy coverage for free. No strings. Send us a copy of just the “Declarations” page from your policy and we’ll let you know what level of exposure you have based on your coverage. Let’s make sure you and your family are properly protected.

Get a Free Evaluation of Your Motorist Coverage

How it works

- Fill out the contact information

- Upload a JPG, PNG or PDF of the “Declarations” page (max 5MB file size)

- Click Submit

- You’ll receive an email confirmation within minutes

- Allow us 2-5 days to review and we’ll contact you with an assessment and recommendations

Why We’re Offering This Free Service

As experienced auto accident injury attorneys, we’ve seen the benefits of having UM and UIM, and the financial disruption when not having it. You shouldn’t have to drive in fear that your next accident could bankrupt you. We are living through some challenging times right now. Extending a helping hand seems like the good thing to do. We want you to feel safe, secure and protected without ever having to stress the details. At KL, we built our business on making your life a bit easier. We turn complex into simple. We do this so you can focus on what matters most – your health and your family.